A whistleblower has unravelled a disturbing dossier on Devki Group conglomerate, known for Steel manufacturing, Simba cement as part of its subsidiaries .

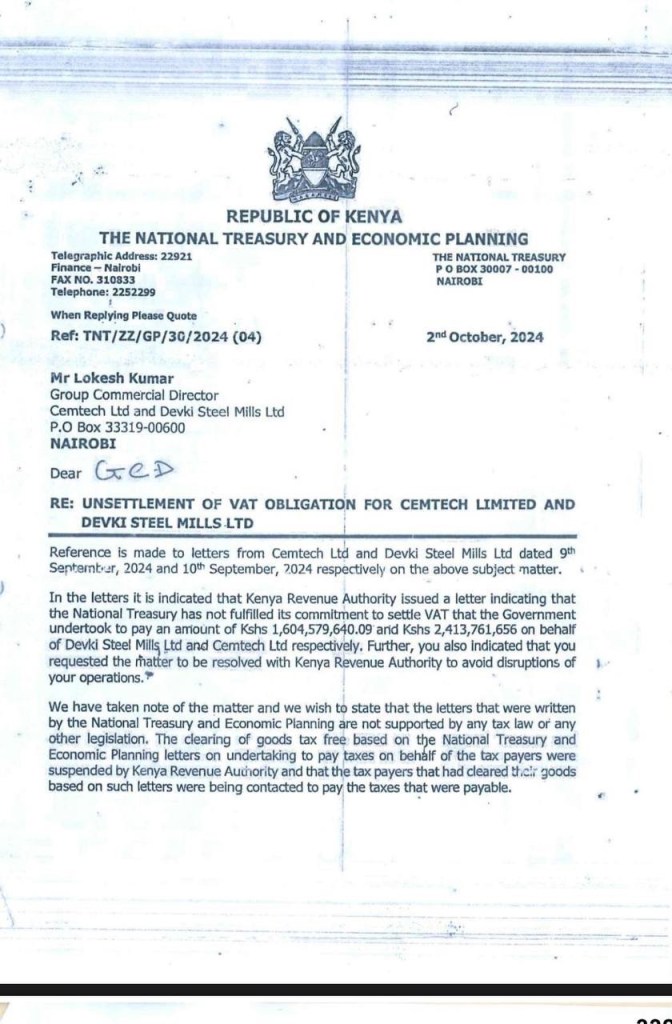

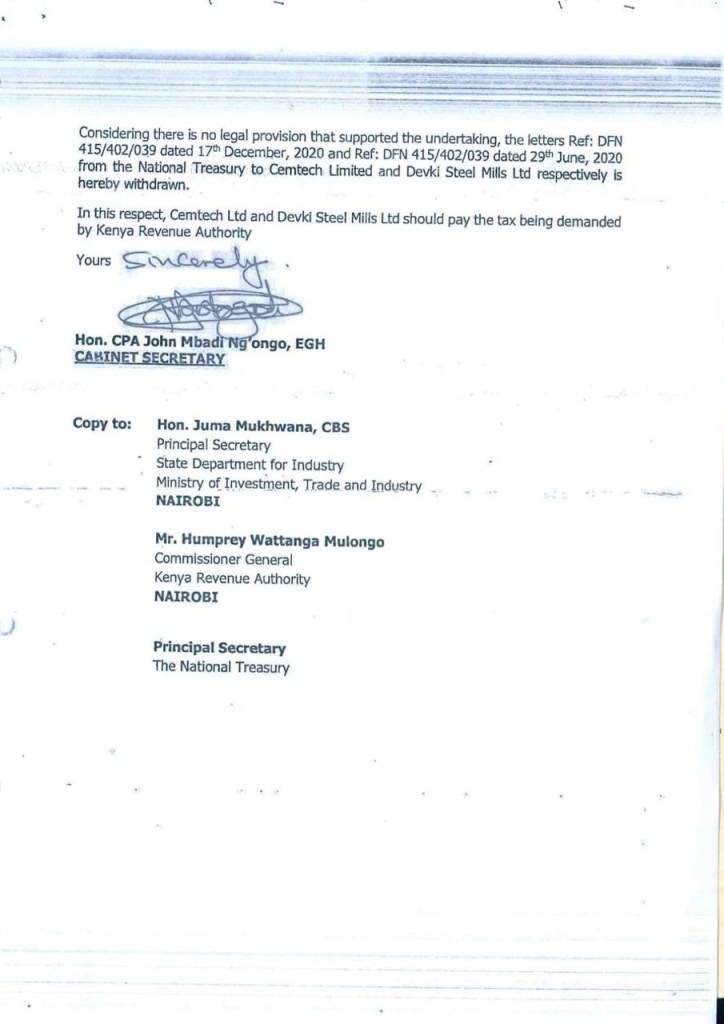

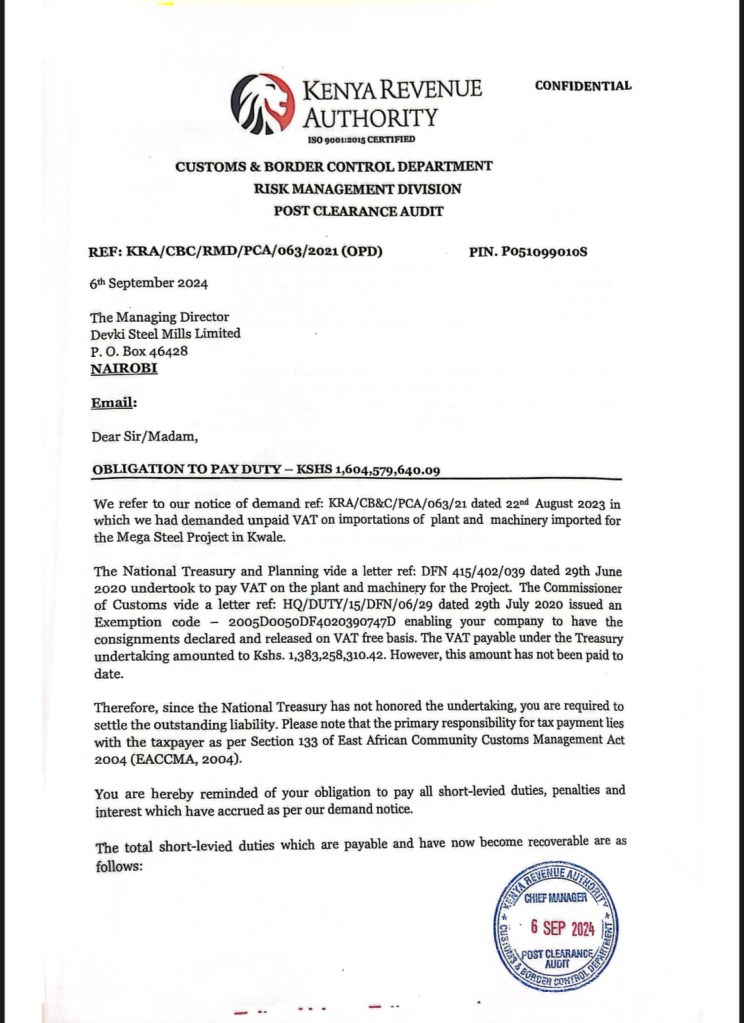

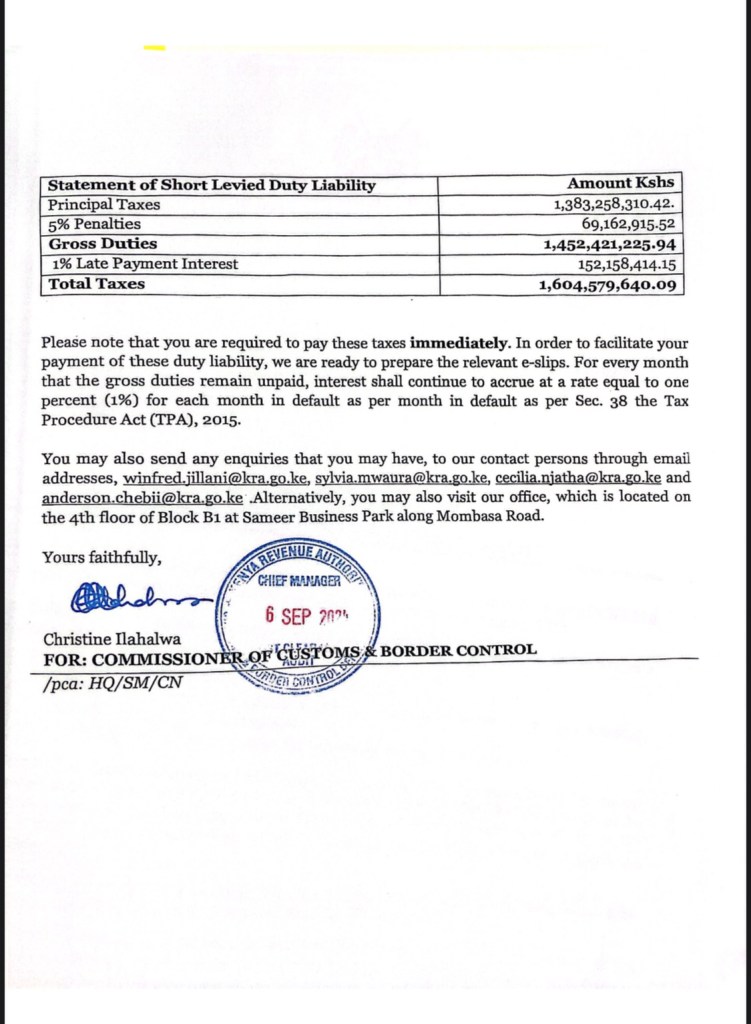

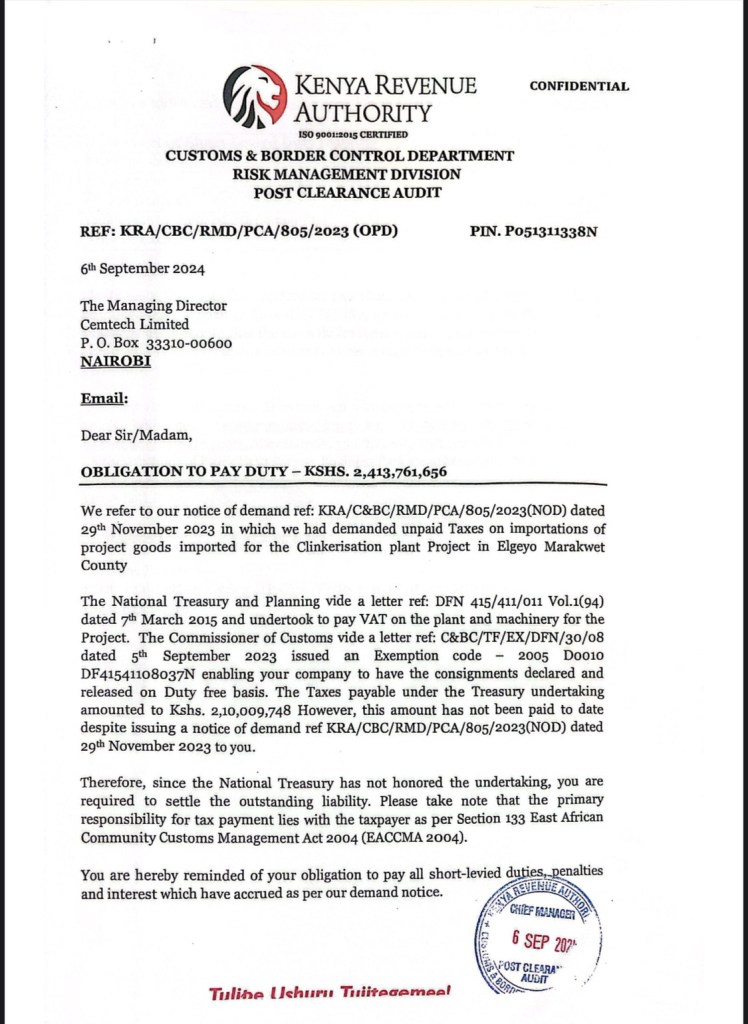

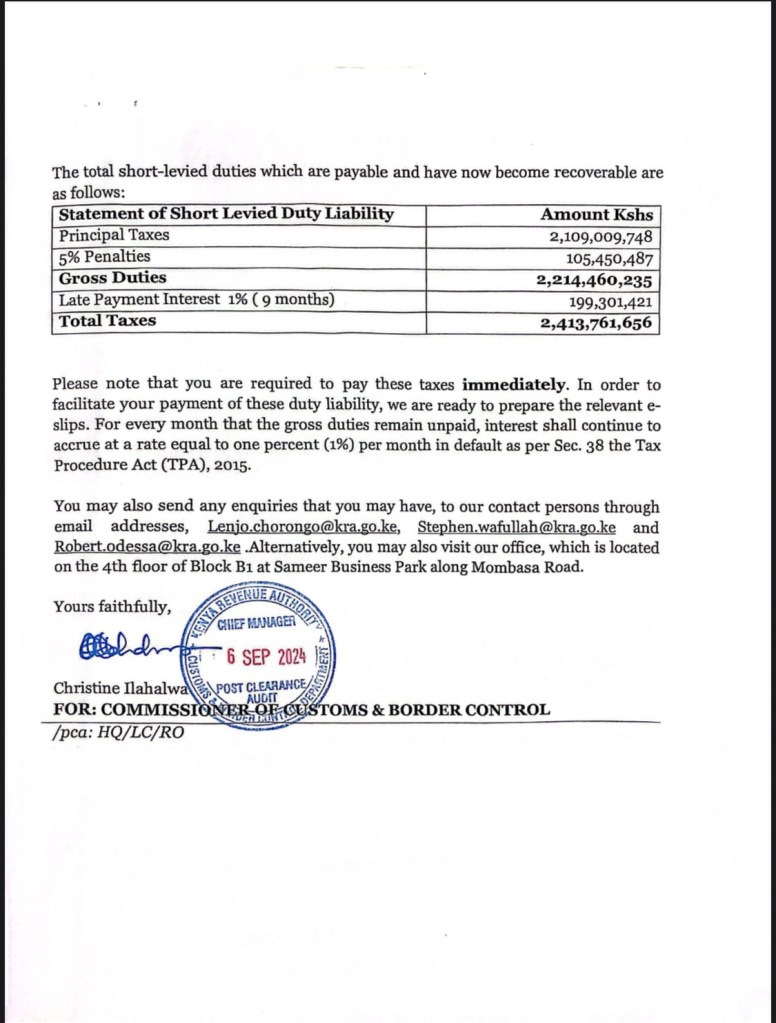

In the leaked email are allegations that the Devki Group, through its subsidiaries Devki Steel Mills Limited and Cemtech Limited, is at the centre of efforts to coerce the Kenya Revenue Authority (KRA) into overlooking tax liabilities amounting to Kshs. 1.6 billion and Kshs. 2.4 billion respectively.

The email details a disturbing pattern of intimidation, with claims that public officials at KRA and Treasury who resisted the demands were subjected to direct threats of dismissal and investigations by anti-corruption agencies.

These coercive tactics allegedly extend beyond tax issues and touch on regulatory violations.

Among the most shocking allegations is the revelation that Simba Cement, a Devki Group subsidiary, was allegedly caught selling underweight cement bags which is a clear violation of Kenya Bureau of Standards (KEBS) regulations but KEBS officials were reportedly silenced with threats of job termination.

Competitors, fearing retaliation, have refrained from speaking openly, with some reportedly considering exiting the Kenyan market due to an environment increasingly monopolized by the Devki Group.

There are also concerns over poor-quality steel products allegedly returned by major contractors and Chinese firms.

Below is the full unprecedented whistleblower account.

“Anonymously Reporting Coercion Over Tax Obligations and Unethical Practices

To Whom It May Concern.

I write this letter anonymously, driven by the need to expose the intimidation, corruption, and unethical practices that are eroding the integrity of public institutions in Kenya. The current situation involving Devki Steel Mills Limited, Cemtech Limited, and their subsidiaries has escalated into a systemic crisis, fueled by political interference and corporate collusion. The fear of reprisal prevents me and others from coming forward openly, but the truth must be told.

In addition to the outstanding tax liabilities—Kshs. 1,604,579,640.09 for Devki Steel Mills Limited and Kshs. 2,413,761,656 for Cemtech Limited—the manner in which pressure is being applied to KRA and Treasury officials is deeply disturbing. Reports suggest that officials who resisted these demands have faced threats and intimidation, creating an environment of fear within key institutions.

When a senior KRA official escalated the matter directly to the President, seeking clarity, the President’s stance was unequivocal: “No one will be given exemptions; there will be no waivers whatsoever.” This decisive response reflects the President’s commitment to fairness and the rule of law. However, these words have yet to translate into action, as the intimidation persists.

Beyond the tax liabilities, unethical practices extend into other areas of the Devki Group’s operations. Speaking to cement industry players, many expressed fear of speaking out, as they are terrified of being targeted. A subsidiary of the Devki Group, Simba Cement, was caught by KEBS selling 47kg cement bags instead of the standard 50kg. However, KEBS officials were reportedly warned that their jobs would be at risk if they pursued the matter further.

The monopolistic environment cultivated by the Devki Group has created significant challenges for competitors. A representative from Bamburi Cement disclosed that the hostile market dynamics are forcing them to consider exiting the Kenyan market, leaving it open for Devki’s dominance. Speaking to two large steel companies, they raised concerns about poor quality products from Devki’s steel mills.

These companies, whose main customers are large contractors and Chinese projects, revealed that they often have to return goods due to substandard quality, something they cannot risk with high-stakes projects.

These actions are not just unethical but detrimental to Kenya’s economy and reputation. The monopolistic tendencies and compromised quality standards harm competitors, contractors, and the public. The culture of threats, blackmail, and coercion targeting public officials, regulatory bodies, and industry players perpetuates impunity and undermines our institutions.

I am too afraid to come forward openly for fear of being targeted, fired, or falsely accused. However, I urge those in positions of power to take action. The manipulation of public institutions for personal and corporate gain must end. The President’s firm stance against waivers and exemptions must be enforced. Regulators like KEBS and KRA should be empowered to act independently, free from political and corporate interference.

This letter is a plea for justice and reform. The Kenyan people deserve institutions that operate with integrity, businesses that adhere to ethical practices, and leaders who prioritize public welfare over personal or corporate interests.

Sincerely,

A Fearful Insider.

This is a cry for help. We have no one to reach out to. Nowhere to go. This is our final location. More information to follow. We are motivated. We are positive. We are willing. Please give us your attention.

Attached are our letters for which we are facing pressure of withdrawal.”

Tecno Kenya Sh400 billion Tax Evasion Allegations and silence of KRA on it despite being aware.

How TECNO Kenya colludes with rogue KRA officers to evade paying tax running into billions of shillings – KRA officers collect bribes every week at Cardinal Otunga Plaza.

Transsion Holdings, the Chinese-based smartphone maker behind popular brands; TECNO, Infinix, itel and smart accessories brand oraimo is currently locked in serious claims of massive tax evasion, smuggling of undocumented Chinese workers and serious labour abuses in Kenya.

Whistleblowers have accused the firm of fleecing the country. According to investigative reports, the company which has been in operation in Kenya for over a decade, has evaded paying taxes amounting to over Sh400billion.

Private Tax.

There are accusations that the Chinese firm has been colluding with corrupt Kenya Revenue Authority (KRA) officials in the wider scheme to evade paying taxes.

“The Tecno and all Transion affiliates’ tax evasion is shocking. Insiders tell me we are talking about an excess of Ksh. 400 Billion evaded. KRA staff collect what we call a private tax to enable the crimes.” Blogger Nyakundi reported.

“I have very credible information that some KRA officials met with the Tecno country manager people and the KRA officers promised them protection amid tax evasion allegations. Tecno doesn’t have a CEO, they have a country manager named Ray Fang” he added.

The revelation of KRA officials allegedly collecting private taxes from Chinese companies like Tecno raises serious concerns and calls for thorough investigations into the claims.

Transparency and accountability must be upheld to ensure fair taxation practices and prevent tax evasion.

Despite not being listed among Kenya’s top tax-paying companies, Tecno allocates a significant Kshs. 3 billion -4 billion annual marketing budget to Kenya.

The company manufactures devices for local brands like Safaricom and JTL.

However, there have been allegations that Tecno conducts salary and other payments in cash, potentially skirting typical financial reporting.

Market Dimensions Limited that offers Human Resource (HR) Services to Transsion is also alleged to being a conduit in the larger tax evasion scheme.

One of Tecno’s suppliers has alleged to have experienced favoritism towards Chinese suppliers, upfront payment, and flexible timelines, while Kenyans were pushed to fund projects and wait 30 days.

He claims the Tecno managers dictates costs and constantly ask for kickbacks, which could frustrate his work. He adds that they pay suppliers cash, and their finance office, Cardinal Otunga Plaza in Nairobi, has a safe with millions daily transactions, where marketing and brand managers look for kickbacks.