As Kenyan transitions its healthcare system from the National Health Insurance Fund to the Social Health Authority (SHA), including the Social Health Insurance Fund (SHIF) and Healthcare Fund, a staggering deal worth hundreds of billions is unfolding, with a web of elites poised to reap the benefits.

Among those set to profit are President William Ruto’s close associates (Adil Khawaja and co), influential businessmen (Jayesh Saini and co) and powerful figures in the corporate world, all linked to the Ministry of Health.

They will control the Social Health Authority (SHA), which manages three funds – the Primary Healthcare Fund, receiving Sh50 billion from the government; the Social Health Insurance Fund, raising Sh148 billion annually through member contributions and the Emergency, Chronic and Critical Illnesses Fund requiring Sh75 billion yearly.

The SHIF deal, operational from October 1, 2024, aims to replace the National Health Insurance Fund (NHIF) with a new system requiring all households to contribute 2.75 per cent of their monthly income. This represents a significant increase for wealthier households, with some paying up to Sh27,500 monthly compared to the NHIF’s capped contributions of Sh1,700.

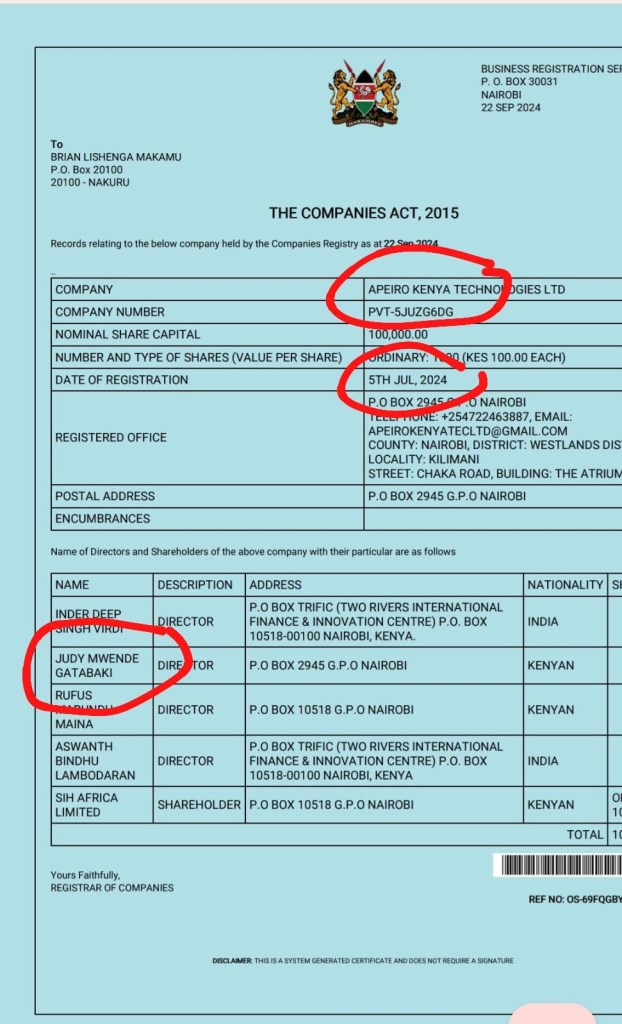

At the heart of the deal is Apeiro Ltd, which holds the largest stake of 59.5 per cent in the consortium contracted to implement the UHC technology-based system.

Other members include Safaricom, with a 22.6 per cent stake, and Konvergenz Network Solutions, with 17.9 per cent. Apeiro, a recently registered Kenyan company, has deep ties to international corporate giants and key figures in President Ruto’s circle.

Apeiro is a subsidiary of Sirius International Holdings, which in turn is a part of Abu Dhabi’s International Holding Company (IHC), a firm with ties to India’s Adani Group. The company’s directors include Mwende Gatabaki, the wife of President Ruto’s economic adviser, David Ndii.

“Our aim is to ensure that everyone can access high-quality medical care, contributing to financially sustainable universal health coverage for all. We stand at the junction of Health and Technology, offering countries assistance throughout their healthcare transformation journey,” the company states on its website.

David Ndii, a figure often mired in controversy, has faced scrutiny for his public statements on Kenya’s governance. He recently commented on corruption, stating, “We will leave Kenya as corrupt as we found it”.

Apiero is undoubtedly owned by Nairobi west hospital owner Jayesh Saini who also owns Bliss medical, Lifecare medical, Kitengela West Hospital, Medicross hosp among many more.

It turns out the same company director in Apiero Kenya Technologies ltd who holds the largest share in the deal is also the same Director partner in Jayesh Saini’s Medicross hospital – RUFUS MARUNDU MAINA of address P.O BOX 3421 NYAYO STADIUM. Not a coincidence. These are proxies.

The very same address for Rufus Marundu is the same for Jayesh Saini’s MAKL and the same for Mr. MADNI ALI ASIF ANSARI, who also happens to be the director of both MAKI Limited and BLISS HEALTHCARE (K) LIMITED. So, Apiero Ltd is basically Jayesh Saini.

Adil Khawaja, President Ruto’s personal lawyer and whose associate firm is the legal provider in the Sh104 billion SHA – Safaricom deal. The duo have also allegedly bought a hill inside Greatrift lodge and close neighbors displaced. The area is now a conserved area in the map.

Safaricom, another major player in the SHIF deal, is Kenya’s leading telecommunications company whose board is chaired by lawyer Adil Khawaja.

The SHIF is not the only deal under scrutiny. Mr Silas Simotwo, closely tied to an insurance company — a firm linked to President Ruto — has been appointed to chair the Digital Health Fund, a key component of the authority that will oversee SHIF operations.

The Digital Health Fund manages several healthcare funds, including the Primary Healthcare Fund (allocated Sh50 billion) and the Emergency, Chronic, and Critical Illnesses Fund, which requires Sh75 billion yearly.

The NHIF transition comes amidst widespread public concern over the cost of contributions for the new fund and the overall transparency of the deal. Households across the country are required to contribute a portion of their income to SHIF, with wealthier families seeing their payments soar. This shift is a marked contrast to the previous NHIF model, where most families contributed a flat rate.