Founded in 2014, Cytonn Investment found its way into the market masquerading as a firm involved in private equity, real estate and asset management business.

When launching operations, Cytonn ran glitzy ads in which it invited prospective investors to be “Cytonnaires” and not just regular millionaires.

Cytonn presented to investors two products with similar names – Cytonn High Yield Fund and Cytonn High Yield Solutions.

Cytonn High Yield Solutions had “an attractive” 18 percent return per annum and in the process collected over Sh10 billion from investors.

It turned out that while the High Yield Fund was regulated by CMA, High Yield Solutions was not, meaning investors’ billions may have gone down the drain.

More than 4,000 investors were lured to splash billions into what perfect initially looked like a lucrative deal not knowing that they were entangling themselves into a trap.

The kind of uproar that followed forced the national assembly to form an inquiry into Cytonn and other entities where investors had lost billions of shillings.

The company set up two vehicles whose main role was to collect cash from investors, with the money to be deployed in the real estate market.

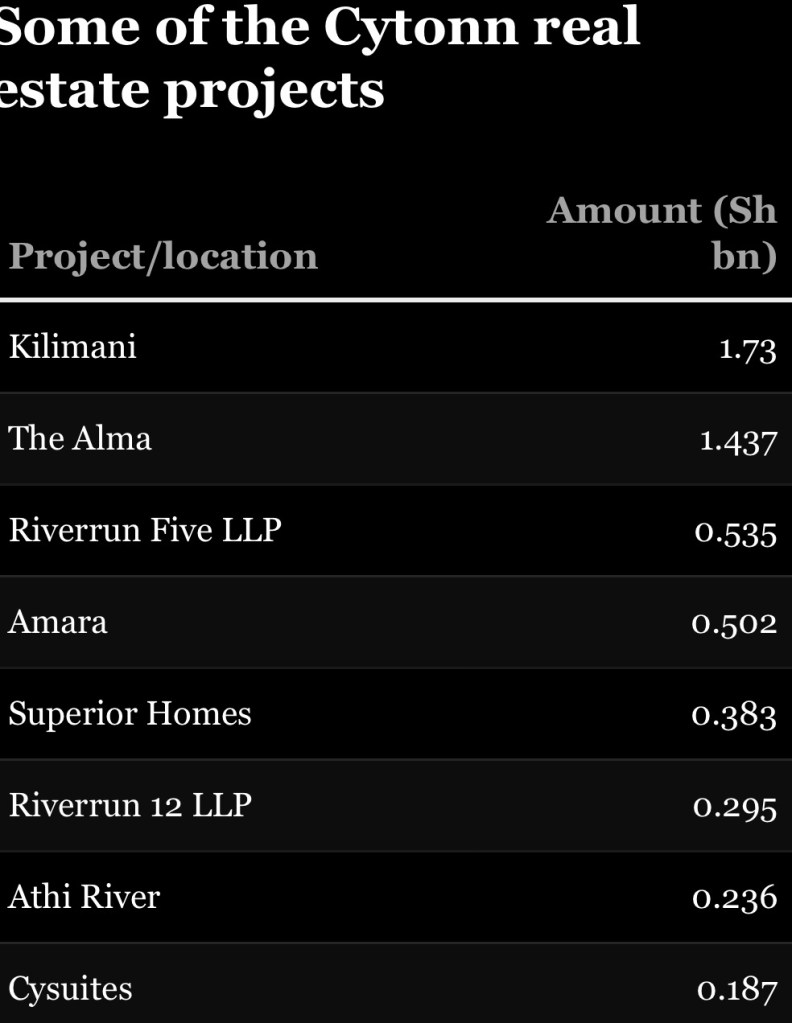

The largest, Cytonn High Yield Solutions LLP (CHYS), managed to raise Sh11.1 billion from 3,116 debt investors. They included Johnson Masinde and Daniel Nyakundi who pumped in an aggregate of Sh34 million.

Another entity, Cytonn Real Estate Project Notes LLP (CPN), raised Sh4.1 billion from 886 people.

The investment firm, in its marketing materials, suggested to investors that the risk of default was low and that the parent firm (CIMP) could absorb losses on their behalf.

For about three years, investors enjoyed the highest returns in the fixed-income world which Cytonn said was due to the elimination of middlemen such as banks by connecting savers with property developers directly.

Cytonn, however, went into a comprehensive default in early 2020, a move it blamed on the outbreak of the Covid-19 pandemic.

As legal battles unfolded, it emerged that Cytonn’s founders had deliberately structured the business to shield the real estate assets from the investors.

In stark contrast to the marketing materials, the promoters told judges that CIMP was a distinct and separate legal entity from the cash collection vehicles CHYS and CPN.

Further, those who had invested their money were only holding loan notes that had no claims on the projects such as The Alma, Taraji, Superior Homes, Cysuites and Riverrun.

The administrator Kereto Marima who was appointed to manage CHYS and CPN in October 2021, told the court that he had been unable to recover investor funds.

It later emerged that Mr Marima had an earlier business relationship with Cytonn promoters who continued to manage the real estate projects despite the administration which has since been terminated in favour of liquidation.

Cytonn had on its payslip veteran Radio host Caroline Mutoko to promote their lucrative pyramid scheme as an influencer decorated by virtue of her background at Kiss Fm —was used to lure victims into the scam.

It is imperative to note that such activities were limited to her social media accounts in which she boasts million followers.