The Sacco Societies Regulatory Authority forensic audit on the Kenya Union of Savings and Credit Cooperative Society during the era of George Ototo as CEO has exposed how leading cooperatives made illegal deposits of Sh18 billion.

Kuscco is being investigated in matters to do with illegal deposits- taking business.

The forensic report is now ready and has recommended criminal charges against the Ototo team. The board members set to be arrested as per the forensic report are Magutu (then chairman), David Lagat (then vice chairman), David Ogega, Alfred Mlolwa, Peter Manga, John Sigei, Wilfred Aima, Bernard Ngunjiri, Ann Mutinda, Henry Okwatch and Hesborn Malova.

The auditors are shocked by the big gap in the declared Sacco deposits and what is actually held by Kuscco, which is reportedly running into billions of shillings.

According to sources, Ototo is back in action since the formation of a broad based government of president William Ruto and ODM leader Raila Odinga. He is now lobbying for his return into the office on grounds that he was a victim of new Kenya Kwanza regime when it came to power.

With new Cooperative CS Wycliffe Oparanya having taken over from sacked Simon Chelugui, the removed Kuscco directors who to date claim their removal was illegal are praying to make triumphal comeback.

Remember, Oparanya represents ODM in the broad based government.

The forensic report has also unearthed how the directors borrowed huge unsecured loans from the Sacco and which did not protect the interests of the Sacco members.

Chelugui directed Sasra to conduct a thorough investigation and recommend appropriate actions, including sanctions on Kuscco and its directors. The initial report saw the removal of the officials from office with the naming of an interim team to manage Kuscco affairs.

Newfortis Sacco

Report indicates that former Kuscco chairman George Magutu while serving chairman New Fortis Sacco in Nyeri influenced the Sacco to deposit Sh800 million that has gone down the drain now that Kuscco is surviving on overdrafts. More about Magutu and Newfortis had previously been published by us here.

It is said that the Ototo Kuscco cartel were giving out 15pc on any Sacco officials that deposited with them. In the New Fortis deal, the officials involved were paid a cool Sh12 million.

Magutu was replaced by John Githinji as chairman of the board of directors on March 15 2024. We have established that Magutu still has influence on the happenings as he is still a member of the board.

The CEO John Mathinji, also seats on the board with Francis Kamau Muiga, Marga Wangeci, David Maina, David Nduhiu, Eustace Mwai, Charles Wanjohi, Charles Muga, Daniel Matu Muturi, Moses Kamande and Charles Kariuki.

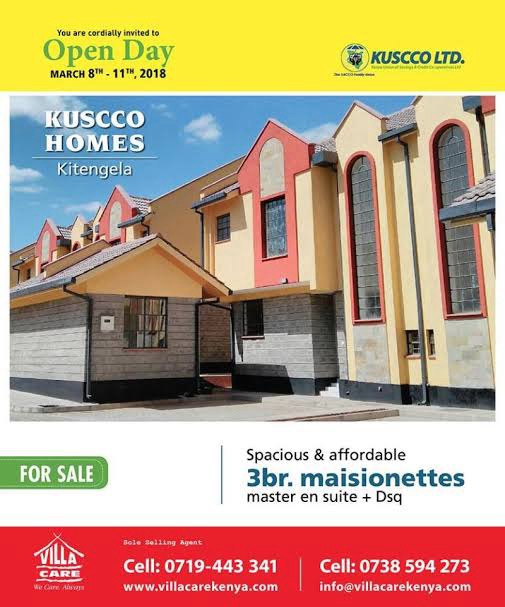

The forensic report in Kuscco fraud has established that Sh18 billion was lost in the white elephant Kitengela housing project.

The houses are being built in a shoddy manner, incomplete and not even fit for residential. The drainage system is poor just like the road network.

New Fortis directors recently recommended payments of dividends and rebates using members cash deposits and not from surplus. Insiders say that New Fortis balance sheet is suspicious and overblown.

It paid members with Sh901 million in dividend on share capital and interests on deposits. Eyebrows have been raised on financial statement presented to members during its 48th AGM in Nyeri graced by Governor Mutahi Kahiga as chief guest.

It is said the Sacco experienced increased annual turnover of Sh1.3 billion in 2022 to Sh1.45 billion in 2023. Outstanding loans with members rose from Sh6.92 billion to Sh7.35 billion in 2023. Withdrawable deposits are said to have grown to Sh7.05 billion 2024 from Sh6.3 billion in 2023. Magutu, Ototo and others face prosecution over Sh1.8 billion in fraud at the Sacco despite them having left.

Apart from the Kitengela Housing project, another avenue used to siphon billions of shillings as per forensic report was KUSCOO Mutual Assurance Assurance with Sh400 million able to be accounted for while Sh1.2 billion cannot be traced.

Metropolitan National Sacco

Apart from New Fortis, Metropolitan National Sacco lost Sh450 million in the Kussco scandal. In April 2022 a report revealed theft at Metropolitan National Sacco by staff but failed to capture the Kussco scam.

Metropolitan is said to have also fraudulently disbursed loans amounting to Sh490 million to its employees while cash amounting to Sh176.9 million belonging to Kisumu, Thika and Kiambu branches allegedly disappeared without a trace.

Metropolitan National Sacco cases also involved forgeries such as falsification of documents, signatures, and fraudulent funds deductions. Metropolitan National membership is teachers and civil servants and started as Kiambu Teachers Sacco, later rebranding to Metropolitan Teachers Sacco until July 2 2009.

On March 22 2022, it saw the former governor of CBK Patrick Njoroge write to the Sasra CEO and the then PS Cooperatives, alerting them to the magnitude of the risk posed by Kuscco’s continued deposit- taking business from regulated and unregulated Saccos.

In the letter, Njoroge expressed concerns about how an entity holding close to Sh20 billion from Saccos was not under the regulator’s purview. The governor known for his straightforward approach and emphasis on compliance in the financial sector, directed Sasra to conduct a review and establish the necessary regulatory framework for Kuscco’s deposit-taking business.

More to follow